extended child tax credit 2025

In a move that could benefit many families House Democrats passed the 175 trillion Build Back Better Act Friday which includes a one-year extension of the enhanced child tax credit CTC. This law raised the amount through 2025.

What Is The Additional Child Tax Credit Credit Karma Tax

1044 PM CDT April 21 2021.

. The moves could prove popular. House Democrats are seeking to extend the expanded child tax credit through 2025. Democrats roughly 2 trillion Build Back.

To reconcile advance payments on your 2021 return. Texas sales tax revenues up 24 percent in December 2021 compared to 2020. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021.

If youre eligible you could receive part of the credit in 2021 through advance payments of up to. The Child Tax Credit was expanded under the Key Ways American Rescue Plan in FOUR key ways. Any changes to a 2022 child tax.

In addition it would provide a 500 per- child credit starting in 2018 for families with children who are enrolled in Head. 2000 For children 6 through 17. An increase in the child tax credit this year that will give millions of parents 3000 to 3600 per child could be extended to 2025 under a plan reportedly set to be unveiled in the coming days by President Joe Biden a pair of reports this week indicated.

Government disbursed more than 15 billion of monthly child tax credit payments in July to American families. Under the current extension in place parents have been granted a total of 3000 for each child age 17 and under and 3600 for each child under age 6. While an advocacy group MomsRising sees this news as highly beneficial the groups chief executive Kristin Rowe-Finkbeiner said that expect extended credit to become permanent.

First its value was boosted to a 3000 maximum for children aged 6 to 17 and a 3600 maximum for children under the age of 6. The child tax credit would be extended for another year. Credit is now fully refundable.

Comptroller Glenn Hegar reported 356 billion in December also were up about 18 percent from 2019. Joe Manchin recently said he would like to see work requirements tied to the credit. As lawmakers race to.

3600 17-year-olds eligible for the first time. The maximum credit amount has increased to 3000 per qualifying child between ages 6 and 17 and 3600 per qualifying child under age 6. Last year the Child Tax Credit got a number of key enhancements.

Due to changes made in the American Rescue Plan to help families households receive 50 of the total credit in six advance installments through 2021 and the rest with a tax refund in 2022. The Biden administration is trying to extend the expanded Child Tax Credit through 2025 and permanently keep in place a key provision that helps low-income families. Total sales tax revenue for the quarter ending in December 2021 also was substantially higher than in 2020 and in the pre-pandemic fourth quarter of 2019.

300 per month for each qualifying. The child tax credit scheme is being distributed to millions of families across America Credit. The ARPAs expansion of the child tax credit resulted in a one-year fully refundable credit of up to 3000 per child age 6 and up and 3600 for children under age 6 to be paid in periodic.

Expanded the existing Child Tax Credit for one year to 3000 for each child age 6-17 and 3600 for. 3000 For children under 6. 250 per month for each qualifying child age 6 to 17 at the end of 2021.

These payments were part of the American Rescue Plan a 19 trillion dollar. The President had implemented it so that families could get boosted payments in advance. Since July the federal government has sent the families of 61 million children monthly payments of 300 per child under 6 and 250 per older child.

300 monthly Child Tax Credit payment extended through 2025 under new Biden plan. 4 1 Amount increase 0 500 1000 1500 2000 2500 3000 3500 Previous Child Tax Credit. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

The enhanced child tax credit that was passed earlier this year temporarily increases the existing child tax credit from a maximum of 2000 a year per child to 3000 for each child aged 6 to 17. The American Rescue Plan passed in March 2021 further increased the amount to help low to middle income families this year only. Under President Joe Bidens 35 trillion 10-year spending plan the increased tax credit and the advance monthly payments would continue through 2025 while.

Get your advance payments total and number of qualifying children in your online account. But others are still pushing for the credit to be extended to 2025. Enter your information on Schedule 8812 Form 1040.

This credit does have a phase-out amount when you reach 400000 of adjusted gross income if you file married filing jointly or 200000. In 2017 this amount was increased to 2000 per child under 17. The extended Child Tax Credit could be extended until 2025This is thanks to the fact that the Democrats presented this proposal in the House of Representatives.

Some members of Congress want it made permanent. The bill would extend the credit for two years then phase it out over four years. The child tax credit for 2021 is right now a temporary boost lasting only through the beginning of next year.

The Child Tax Credit is a federal tax credit that reduces the amount of federal taxes owed by a taxpayer by 1000 for each child under age 17. It means that payments could drop from up to 3600 per child in 2021 to just 1000 after 2025 unless Congress acts. It would also provide an additional 1200 per year for each child under age 18.

Child Tax Credit 2022 How To Receive Your Payments Next Year Marca

A Data Driven Case For The Ctc Expansion In The Ways Means Committee S Recent Proposal Itep

What You Need To Know About Child Tax Credit Personal Capital

Child Tax Credit Is A Critical Component Of Biden Administration S Recovery Package Itep

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Child Tax Credit Extension 2022 When Is The Deadline And Will There Be Payments Next Year

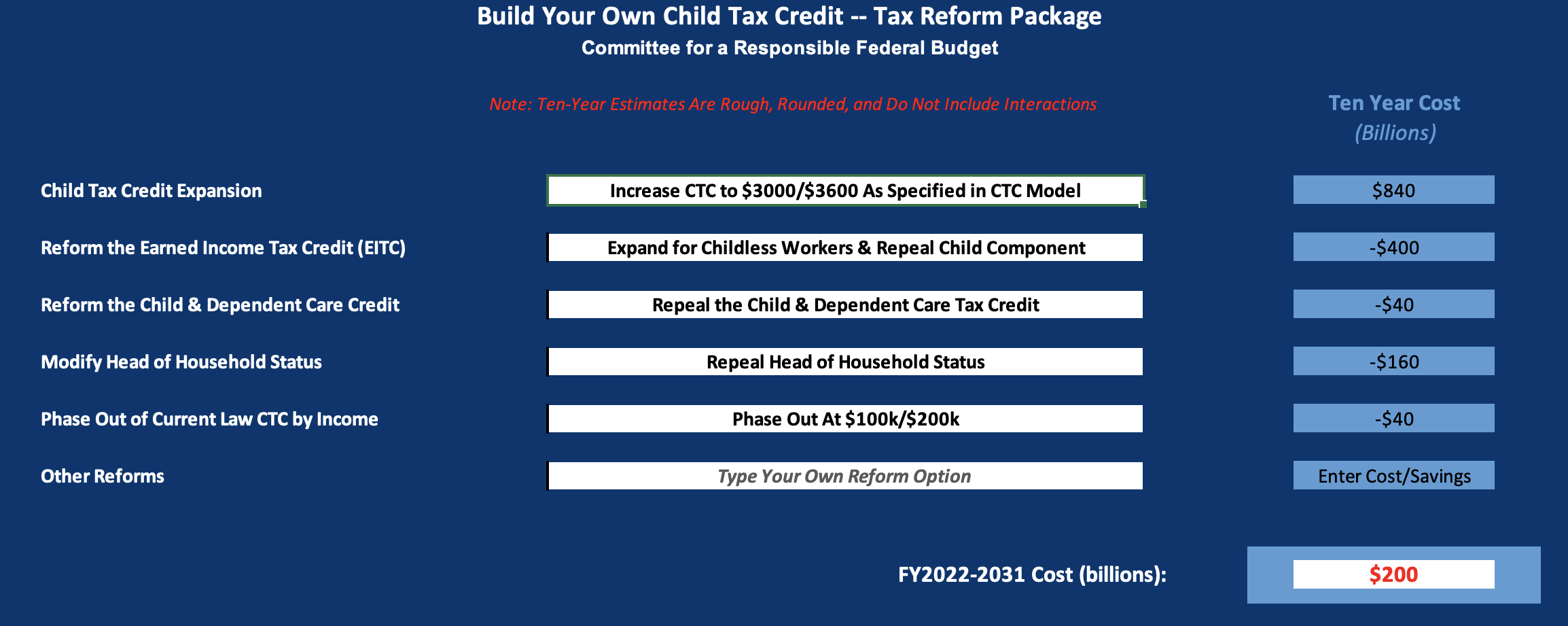

How To Structure A Permanent Child Tax Credit Expansion

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Stimulus Checks Update Proposal Pushes To Extend The Child Tax Credit Until 2025 Pennlive Com

Child Tax Credit 2022 What Will Be Different With Your Payments Next Year Marca

Build Your Own Child Tax Credit 2 0 Committee For A Responsible Federal Budget

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

You Might Get Two Child Tax Credit Stimulus Checks In February If Congress Passes Bill

Racial Justice Organizations Ask Congress To Reinstate Child Tax Credit

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News